Daily Market Analysis and Forex News

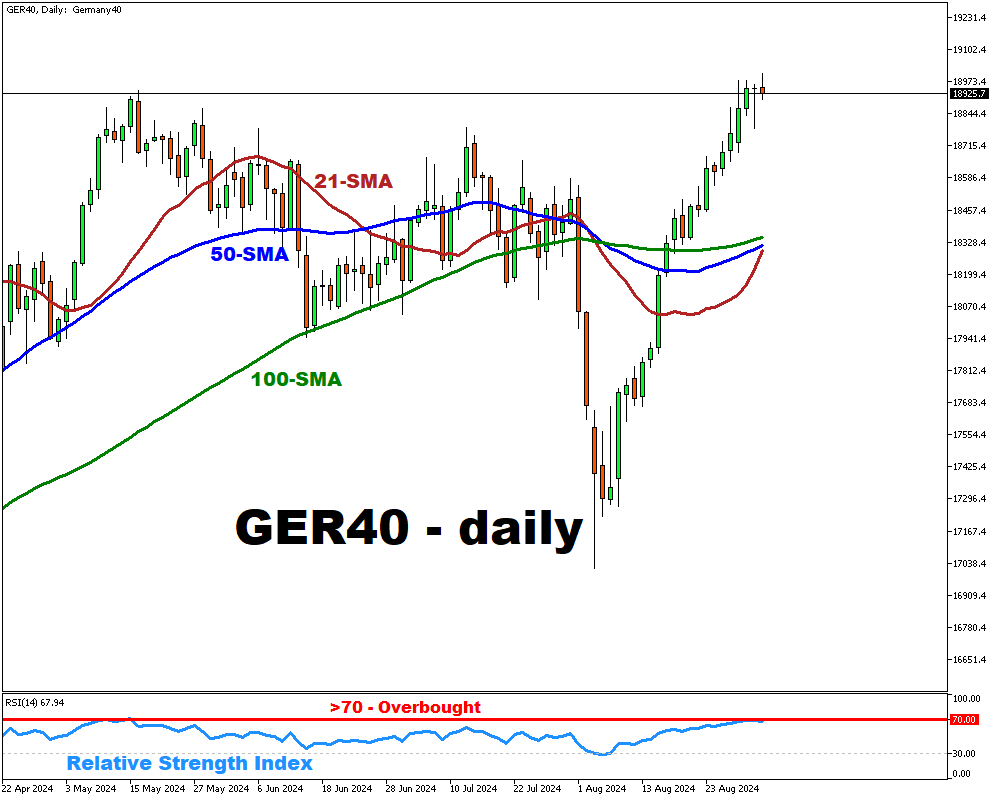

GER40 hits touches new high amid market optimism

- DAX climbs 12% this year, outpacing peers

- Siemens Energy and Rheinmetall see huge gains

- SAP SE rises 42.2% amid tech sector growth

- Investors eye potential ECB interest rate cuts

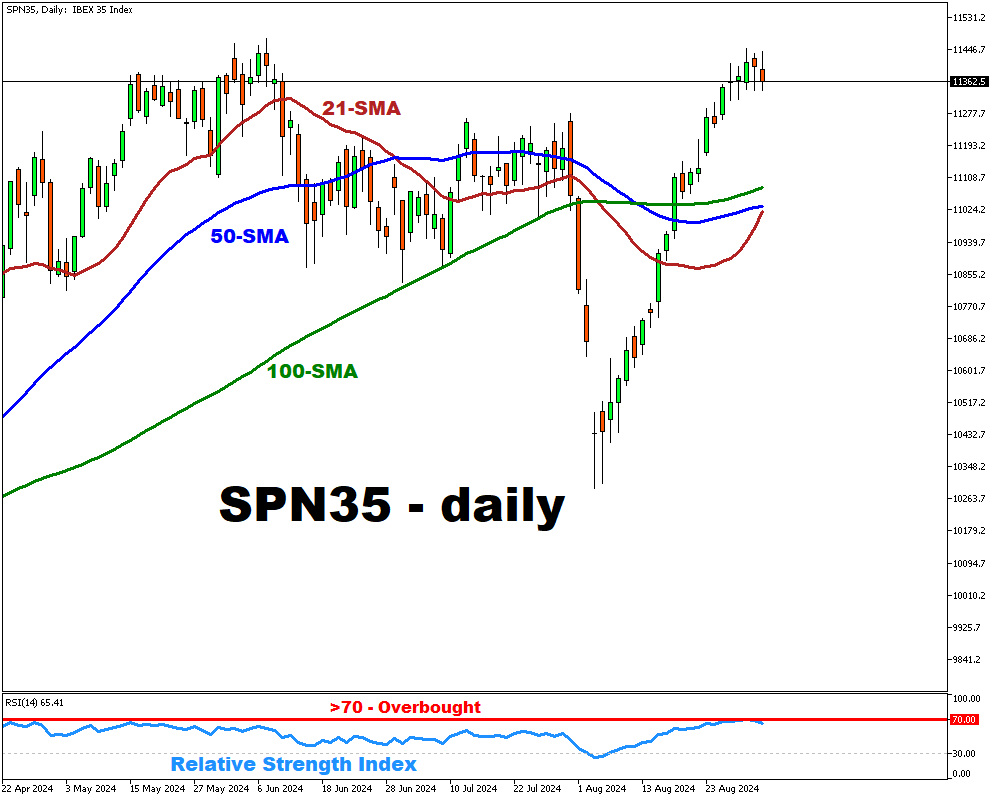

- IBEX 25 declines as Spanish stocks struggle

Germany's DAX Index (GER40) has briefly reached a new all-time high, bouncing back from a mid-August downturn.

The benchmark index has briefly climbed up to 19,007.7 today, eclipsing its previous record set on May 16.

The DAX has gained ~12% this year, outshining its Western European counterparts, including the CAC 40 Index in France.

Sector-specific catalysts and growth stocks along with an anticipation of the interest cuts have contributed to this performance.

Notable gainers include Siemens Energy AG and Rheinmetall AG, which have skyrocketed ~116.6% and 81.6%, respectively.

SAP SE, the largest company on the index, has seen a 42.2% increase, driven by the global tech sector's upward trend.

Despite concerns about a slowing Chinese economy and European recovery, investors are optimistic about potential European Central Bank rate cuts.

IBEX 25 – a leading stock index is experiencing a decline along with its other European counterparts.

The markets are now focused on the key US macroeconomic data which may shed light on the potential magnitude of the anticipated interest rate cut in September.

In Spain, recent employment data has shown unexpected resilience with unemployment reading being less than what market have expected (+21.9K – actual vs 34.4K – expected).

Major Spanish stocks have declined, among which:

- Inditex (-0.3%)

- Santander (-0.7%)

- BBVA (-1.1%)

- Caixa Bank (-1.0%)

- Aena (-0.4%)

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.