Daily Market Analysis and Forex News

USDJPY set for significant turbulence?

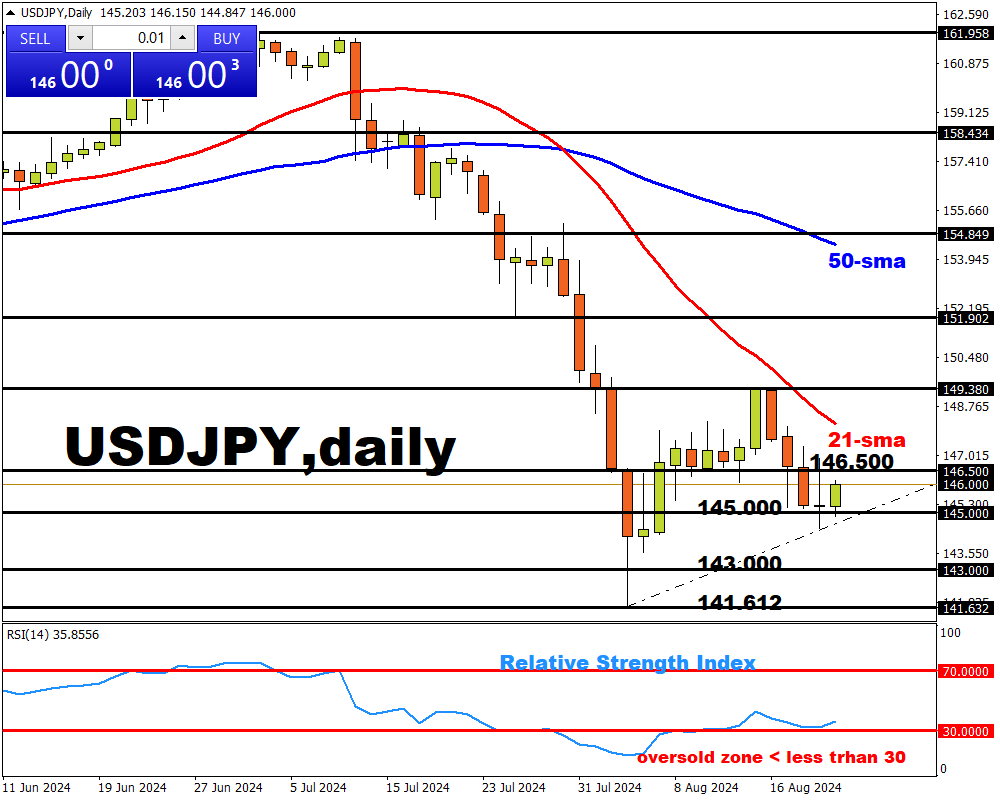

- USDJPY closed as a doji, indicating indecision

- Market focus is on Jackson Hole symposium comments

- Bulls target 146.500 and 148.142

- Bears target 145.000 and 141.632

- Bloomberg predicts 141.92-148.12 7-day trading range

Technically speaking, USDJPY closed as a doji, bouncing off an internal trendline drawn from August 5th’s low at 141.685.

A doji – is a candlestick pattern that signifies indecision.

Yesterday's daily candlestick close has given USDJPY bulls (those looking to see the pair go higher) a lift as it has risen over 0.30% (at the time of writing).

With market participants attention turned to the Jackson Hole symposium and expected comments from the Bank of Japan’s Ueda Kazuo as he faces scrutiny from lawmakers in Japan.

USDJPY bulls may anticipate a dovish tone from Japan and a hawkish stance from Fed chair Jerome Powell for the following levels to be tested:

- 146.500: A psychologically important round number level

- 148.142: The 21-day simple moving average

USDJPY bears on the other hand will take hawkish comments from the BOJ and a dovish posture out of the FED to test the following price levels:

- 145.000: A significant round level price that corresponds to a recent trendline

- 141.632: The most recent swing-low

According to Bloomberg, the potential trading range for USDJPY during the next 7 days lies (with 73% probability) within the 141.92 – 148.12.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.