Daily Market Analysis and Forex News

Gold Nears new Record High, Brent finds strong support

- Gold is 2% shy of its all-time high due to inflation drop

- Market predicts two rate cuts from the Fed soon

- Major buying keeps gold prices rising

- Brent maintains levels above 50-day moving average

- Declining dollar and crude stockpiles boost oil

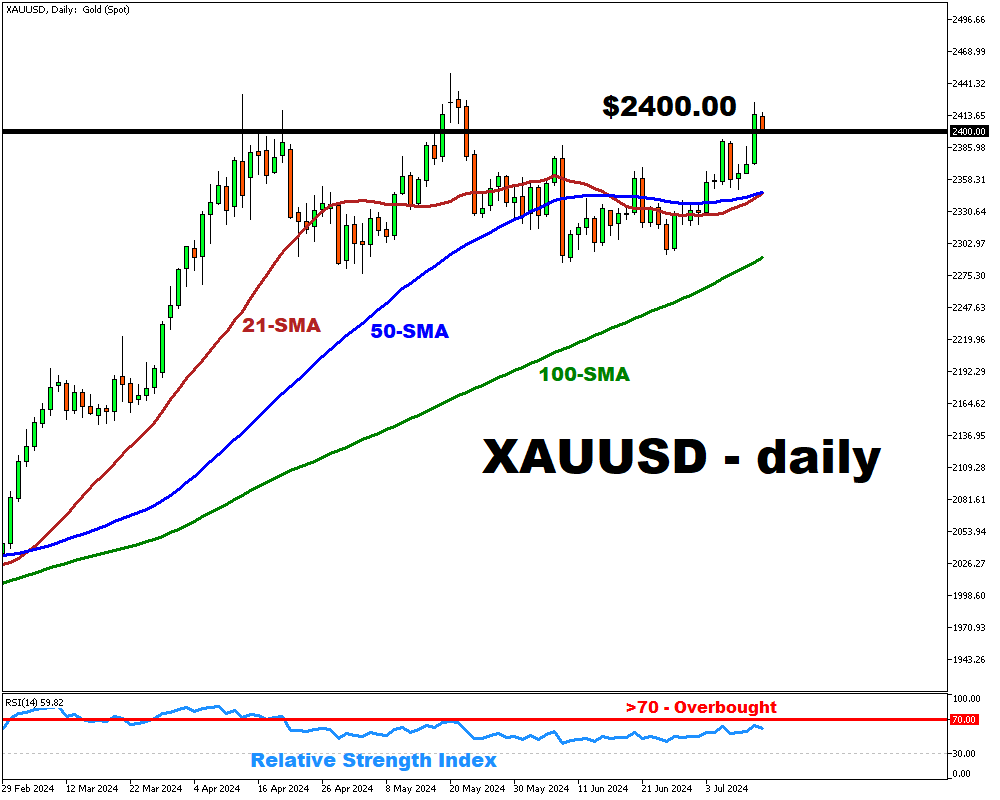

Gold Surpasses $2400 Following softer US CPI data

Gold has surged to within 2% of its all-time high, driven by an unexpected decline in US inflation figures.

With markets now fully anticipating two rate cuts from the Federal Reserve this year, starting as early as September, these expectations foster a favorable environment for the precious metal.

Should the Fed intensify its policy easing efforts and retail investors, along with major central banks, continue their buying spree, bullion may very well reach new record highs by the end of the year.

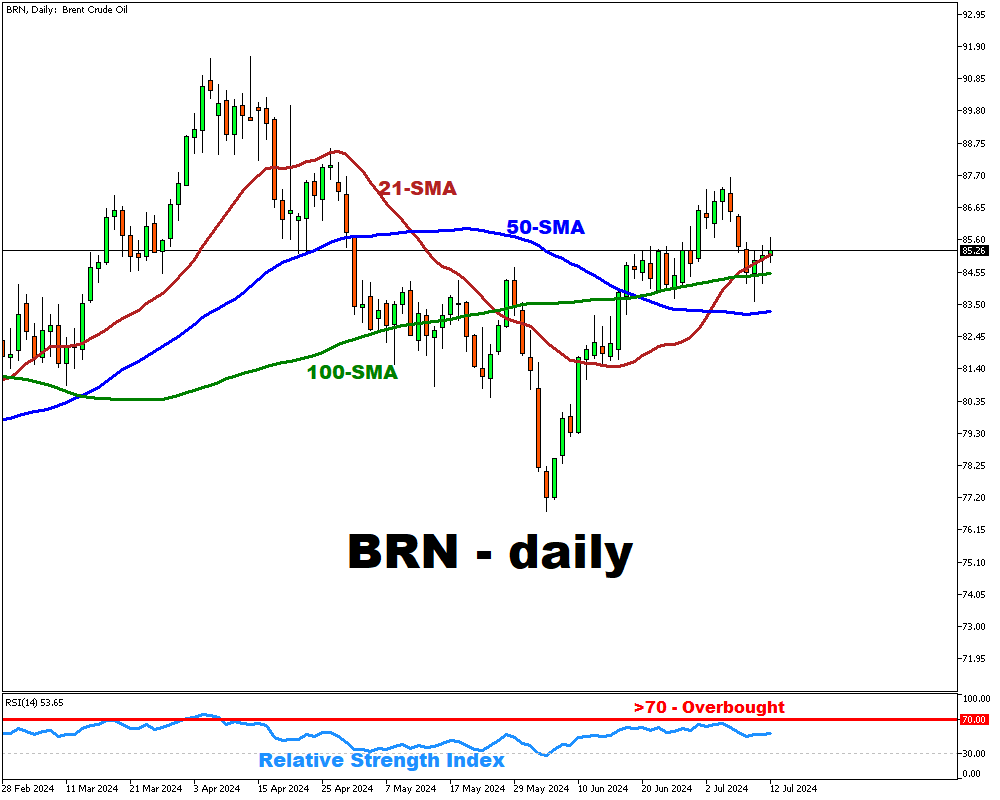

Brent receives support from a weaker US dollar

Brent crude has once again found solid support at its 50-day moving average, maintaining levels not seen since early May.

The recent drop in the US dollar, following the cooler-than-expected inflation data, has provided an additional boost to Brent prices.

Furthermore, the recent decline in US crude stockpiles indicates that seasonal summertime demand remains robust.

Oil bulls are optimistic about potential positive momentum as major central banks move forward with interest rate cuts to bolster global demand.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.