Daily Market Analysis and Forex News

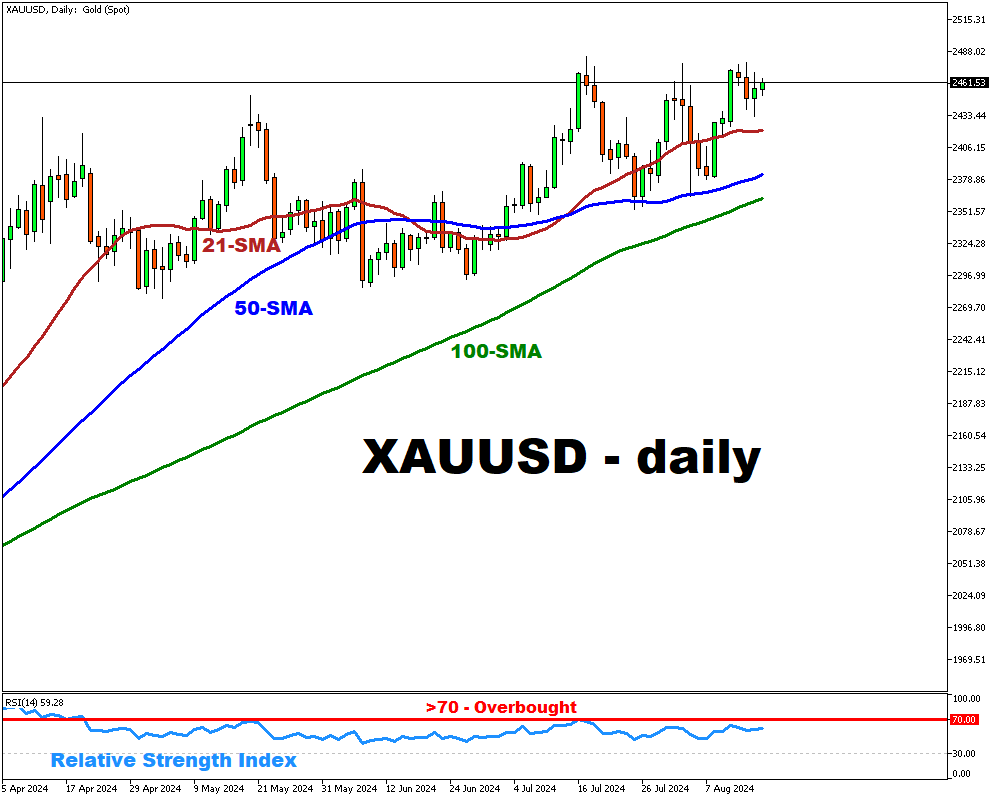

XAUUSD trades near $2,455 amid continuous geopolitical tensions

- Gold hovers near $2,455 amid mixed market signals

- Easing US recession fears reduce gold demand

- Geopolitical tensions may continue to support gold

- Key US data today could impact gold's short-term trend

Gold prices remain under pressure, hovering near $2,455.

It is being influenced by diminishing concerns of a US recession and a potential shift toward a risk-on sentiment.

However, ongoing geopolitical tensions, particularly in the Middle East have provided some support for gold prices, as these situations often increase the metal's appeal as a safe haven.

Today, market participants are going to closely monitor major US economic indicators, such as building permits and the Michigan consumer Sentiment Inde.

Considerable deviation in these reading has the potential to impacts bullion’s short-term performance.

- US Building permits: 1.43M – expected; 1.454M – previous

- Michigan consumer sentiment: 66.9 – expected; 66.4 – previous

Despite 1% increase in July US retail sales and better-than-anticipated jobless claims, the US dollar's momentum remained subdued, which has implications for gold.

Typically, a stronger dollar exerts downward pressure on gold prices.

However, the market's anticipation of a 25-basis point rate cut by the Federal Reserve in September, alongside a slight dip in US Treasury yields, continues to weigh on gold.

Nonetheless, escalating global tensions could counteract these effects, potentially driving gold prices higher.

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.