Daily Market Analysis and Forex News

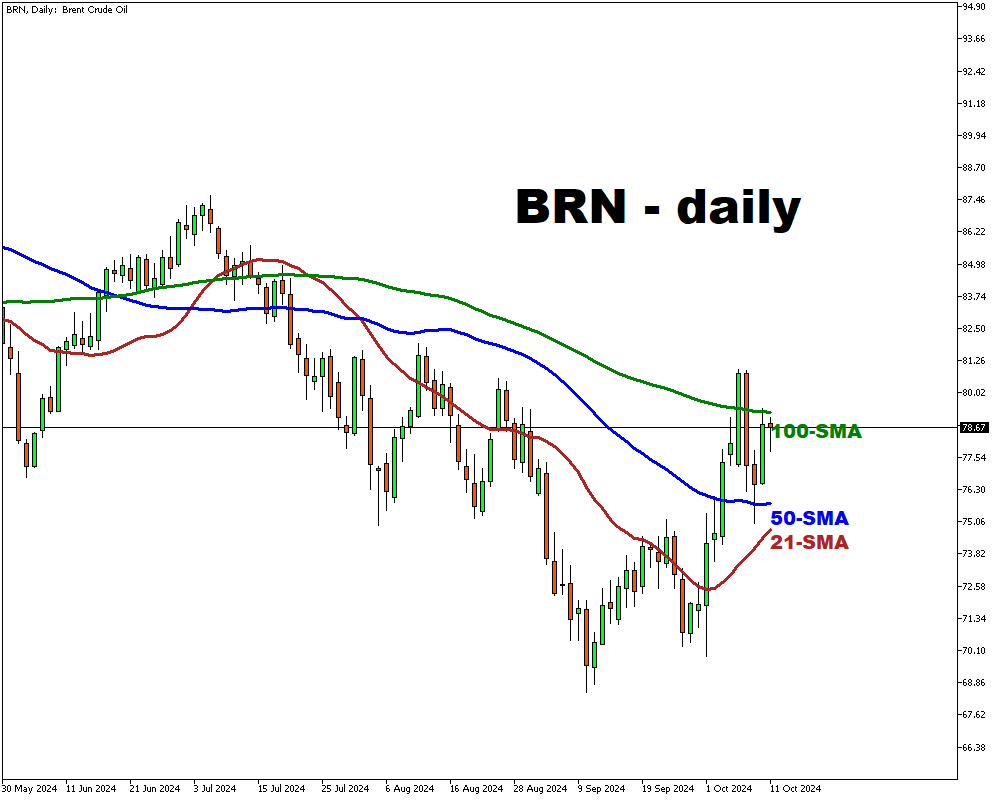

BRN dips amid hurricane and geopolitical risks

- BRN crude fell to ~$78.5 a barrel

- US WTI crude down to ~$74.7 a barrel

- Weekly gains potentially expected despite Friday's dip

- Hurricane Milton affects US fuel consumption

- Libya restores oil production to 1.22 million bpd

Oil prices fell on Friday after a rise the previous day, but potentially remained on track for a second straight weekly gain as investors weighed the impact of hurricane damage on US demand against potential supply disruptions from Israeli strikes on Iranian oil facilities.

Brent crude (BRN) fell to ~$78.5 a barrel, while US West Texas Intermediate crude was down at ~$74.7 a barrel.

Both benchmarks were still expected to end the week higher.

The upward trend in oil prices has been fuelled by geopolitical risks.

Although concerns over high crude inventories and a slower pace of Federal Reserve rate cuts have tempered the recent rally.

Hurricane Milton, which hit Florida left millions without power, potentially dampening fuel consumption in the U.S. Investors are closely monitoring the hurricane's impact on the economy and fuel demand.

On the supply side, Libya's National Oil Corporation announced that it had restored production to 1.22 million barrels per day, approaching pre-crisis levels.

Готовы торговать реальными деньгами?

Открыть счётGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.