Daily Market Analysis and Forex News

Fed cuts deeper than anticipated while BoE is expected to hold rates steady.

- Fed cuts rates by 0.5%, market reacts briefly

- Stocks fell post-Fed announcement

- Gold peaked at $2,600, closed lower at $2,546

- BoE expected to hold rates at 5.0% today

- UK inflation remains above target, core CPI at 3.6%

The Federal Reserve cut interest rates by 0.5%, sparking a brief surge in the market yesterday.

However, stocks ended up falling after Chairman Jerome Powell indicated that the Fed may not be making any more big moves to ease policy anytime soon.

By the end of the trading session yesterday, the S&P 500 dropped 0.3%, while the Nasdaq 100 and Dow Jones Industrial Average fell 0.5% and 0.2%, respectively.

Gold has also touched a new all-time high of $2,600 per ounce before closing in the red at $2,546.

The market is now pricing in another 70 basis points of rate reductions by the end of the year, which is more aggressive than the Fed's own forecast.

Looking ahead, some expect that the Fed's policy easing may especially benefit certain sectors, including small cap stocks, value stocks, and cyclicals.

Rate cuts could also benefit riskier assets such as commodities and crypto.

Investors are now getting ready for today’s BoE interest rate decision.

The BoE is anticipated to hold the interest rate intact at 5.0% amid the sticky inflation.

The UK’s headline CPI reading has remained at 2.2% YoY throughout July and August, above the targeted level of 2.0%.

The core CPI reading has jumped to 3.6% YoY in August (vs 3.3% in July).

"Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further," the BoE has mentioned in the statement following its rate cut on the August 1.

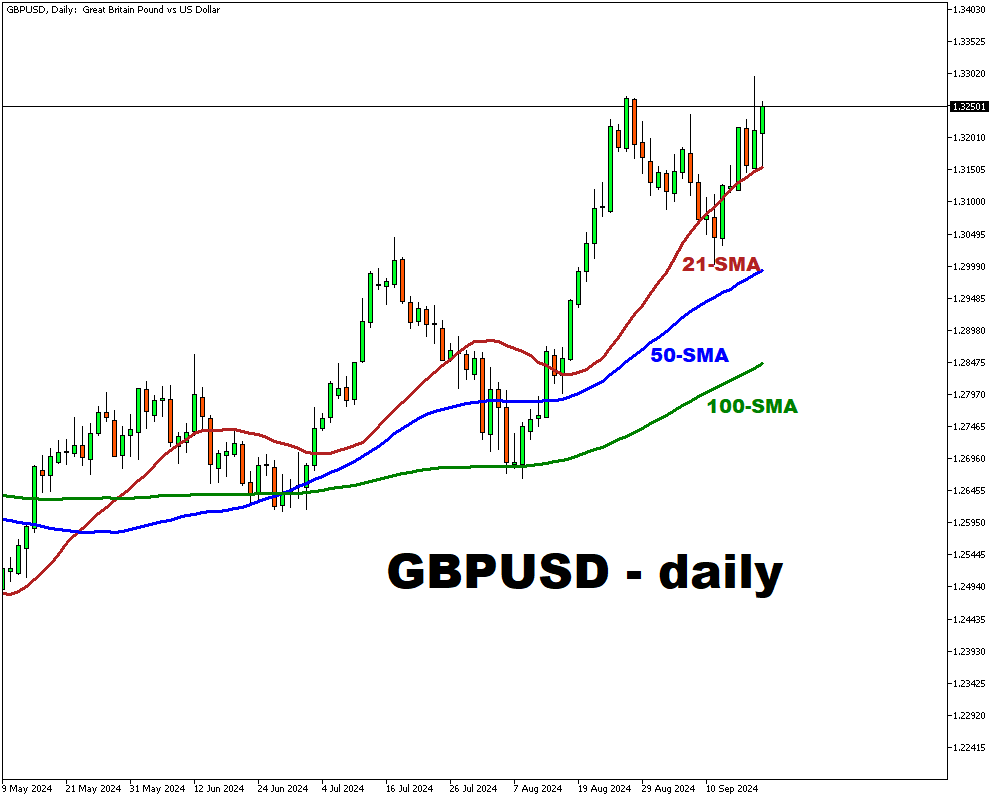

Thus, the markets are expecting a gradual loosening of the policy but without a clear timetable. At the time of writing, the 7-day forecasted (75.2% probability) trading range for the GBPUSD is 1.3707 – 1.3403.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.