Daily Market Analysis and Forex News

Next Week: big tech earnings and vital US macroeconomic readings

- US stock indices face election and Fed rate risks

- NAS100 is 2% below its all-time high

- Alphabet earnings expected to sway market reactions

- Meta and Microsoft earnings forecasted for volatility

- US jobs report may impact financial market risk-taking

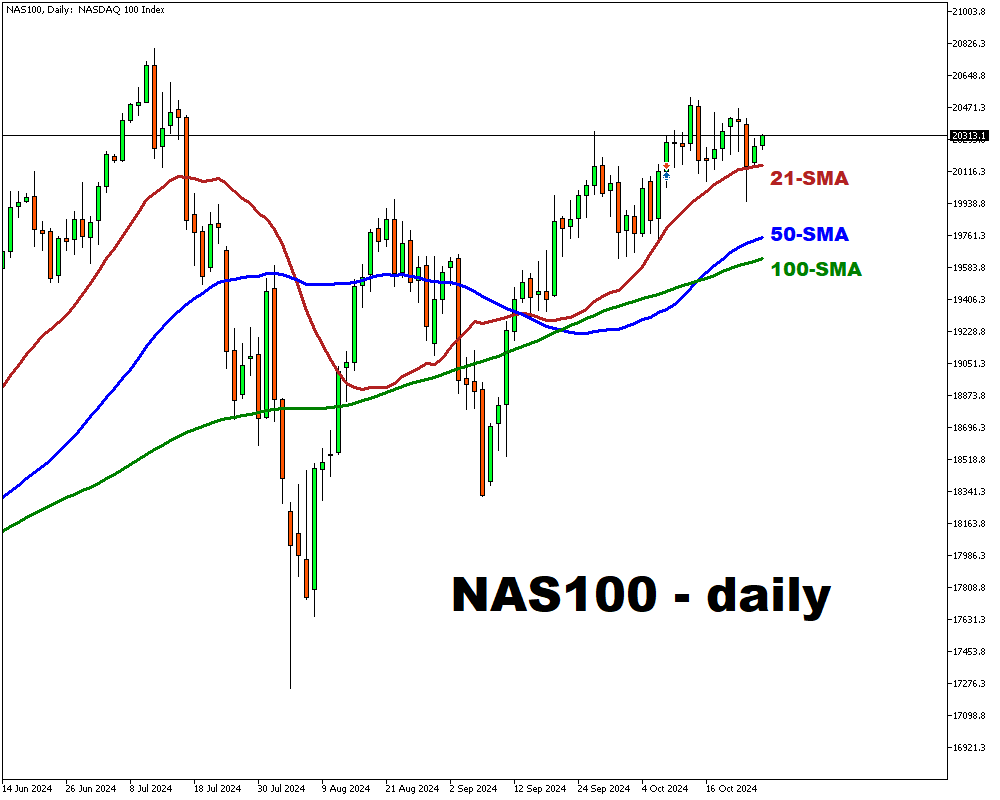

The heady ascent for US stock indices since early September has been on hold for the past couple of weeks, as markets contend with looming US election risks, along with the repricing of expectations surrounding Fed rate cuts.

While the likes of the US500, US400, and US30 have posted fresh all-time highs in October, the NAS100 has yet to do the same, still about 2% below its record intraday peak.

That fact could change this week, given that 5 of the so-called “Magnificent Seven” stocks are due to release their respective quarterly earnings.

Apple, Microsoft, Amazon, Meta, and Alphabet have a combined US$12 trillion in market cap.

Hence, the market reactions to these Big Tech earnings, along with the ever-critical US jobs report, is bound to sway the tech-heavy NAS100 in the days ahead.

Events Watchlist:

-

Tuesday, October 29th: Alphabet earnings (after US markets close)

The share prices of Google’s parent company are expected to move 5.45% up or down when US markets reopen on Wednesday (Oct 30th).

The earnings will have an AI-centric focus, from Google Cloud growth to increased capital expenditure to boost its Gemini offerings.

-

Wednesday, October 30th: Meta and Microsoft earnings (after US markets close)

Once US markets reopen Thursday, the post-earnings reaction for Meta’s share prices are forecasted at 7.3% and 4% for Microsoft, either up or down.

Investors will be eager to know if these tech behemoths can keep pace with the feverish AI-related capital spending, and when such investments could ultimately translate into profits.

-

Thursday, October 31st: Apple and Amazon earnings (after US markets close)

Once US markets reopen Thursday, the post-earnings reaction for Apple is forecasted at 2.6% and 5.9% for Amazon, either up or down.

Beyond their respective AI products, these earnings announcements may also offer signals on global consumption, from Amazon’s Prime Big Deals Days event, to Apple’s iPhone sales in China.

-

Friday, November 1st: US October nonfarm payrolls report

Economists predict that the US labour market added 120,000 new jobs this month, less than half of September’s blockbuster 254k headline figure.

Meanwhile, the unemployment rate is expected to remain unchanged at 4.1%.

A stronger-than-expected US jobs report that bolsters the US economic outlook could amplify risk-taking activities across financial markets, potentially restoring the NAS100 closer to its record high just shy of 20,800.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, October 28

- JPY: Reaction to Japan’s general election

- CN50 index: Reaction to Sunday’s release of China’s September industrial profits

Tuesday, October 29

- SG20 index: Singapore September unemployment

- JP225 index: Japan September unemployment

- RUS2000 index: US September job openings, October consumer confidence

- Alphabet earnings

Wednesday, October 30

- AUD: Australia 3Q CPI

- EUR: Eurozone 3Q GDP; October economic confidence

- GBP: UK budget announcement

- US400 index: US 3Q GDP; ADP October jobs data

- USD index: US Treasury Department’s quarterly refunding announcement

- Meta and Microsoft earnings

Thursday, October 31

- AU200 index: Australia September/3Q retail sales

- JPY: Bank of Japan rate decision; Japan September retail sales and industrial production

- CHINAH index: China October PMIs

- EUR: Eurozone October CPI; September unemployment

- CAD: Canada August GDP

- US500 index: US weekly initial jobless claims; September PCE, personal income and spending

- Amazon and Apple earnings

Friday, November 1

- CN50 index: China October manufacturing PMI

- UK100 index: UK manufacturing PMI (final)

- USD index: US October nonfarm payrolls, ISM manufacturing

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.