Daily Market Analysis and Forex News

Brent crude prices surge amid rising middle east tensions

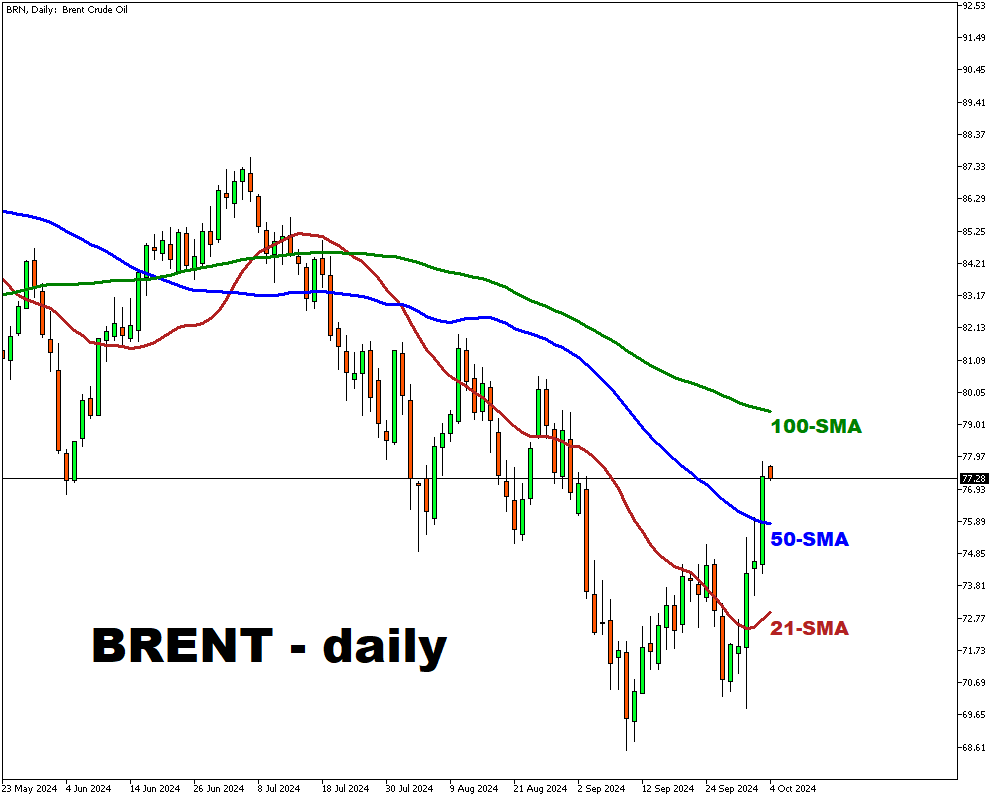

- Brent crude up ~5%, closing at $77.35/barrel on Thursday

- Israel may target Iranian oil facilities soon

- U.S. crude inventories rose by 3.9 million barrels

- Gulf Arab states and Iran met to reduce tension

- Libya restarts oil production, boosting supply outlook

Oil prices experienced a significant increase on Thursday amid escalating worries that an expanding conflict in the Middle East could hinder global crude supplies.

Brent crude rose by ~5%, closing at $77.35 per barrel.

Concerns are mounting that Israel may target Iranian oil facilities, potentially leading to retaliatory actions.

U.S. President Joe Biden indicated discussions were ongoing but noted no immediate actions would occur.

Iran – is a member of OPEC, produces approximately 3.2 million barrels per day, accounting for 3% of global output.

In a related development, Gulf Arab states and Iran participated in a meeting in Qatar aimed at reducing tensions.

The ongoing conflict is raising alarm over potential supply disruptions, particularly from Iran.

Despite rising U.S. crude inventories, which increased by 3.9 million barrels, some market participants believe the market remains well-supplied, aided by OPEC's spare capacity to offset any significant loss of Iranian oil.

Additionally, Libya has restarted oil production at all its oilfields and export terminals, bolstering the argument for sufficient supply.

On the demand front, indications of a robust U.S. economy have fueled expectations for increased fuel consumption, with encouraging labor market statistics released earlier this week contributing to the optimism leading up to today’s important jobs report.

Gateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.