Daily Market Analysis and Forex News

Brent and USDJPY are under pressure ahead of US CPI release

- Brent crude poses a moderate rebound

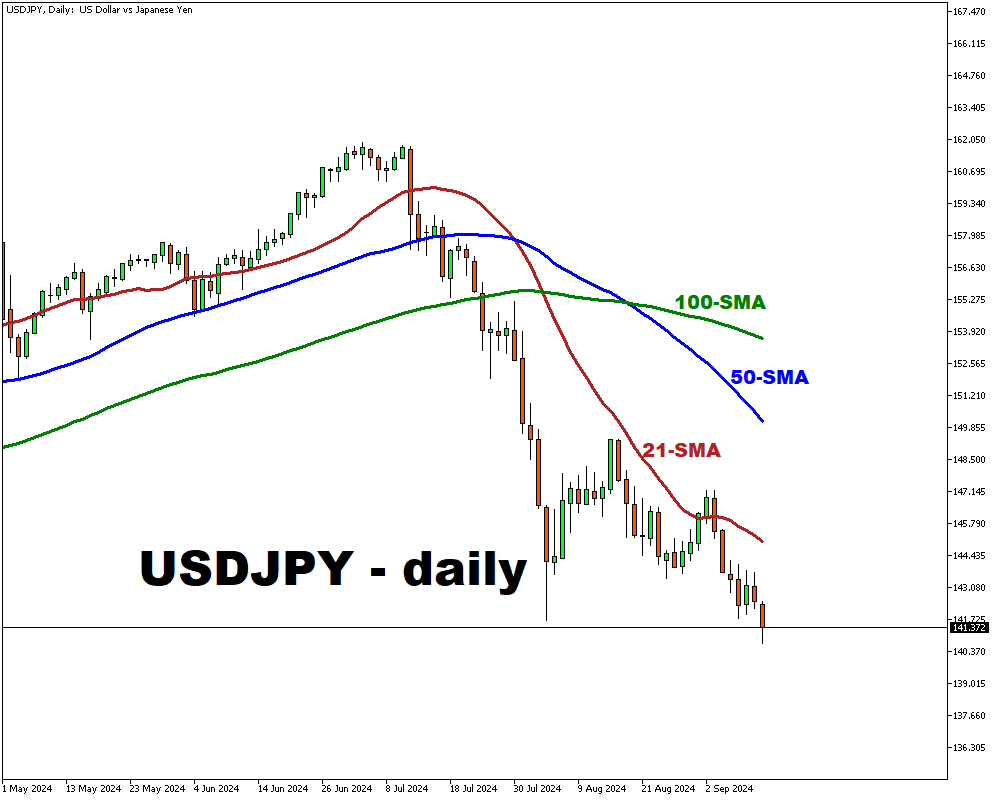

- USDJPY hits its lowest point at ~140.713 today

- US CPI reading due later today

- Diverging policies pressure USDJPY

- OPEC revises demand forecast, adding bearish outlook

Both Brent and USDJPY have touched their lowest points so far this year with Brent showing a moderate rebound today due to supply disruption fears and declining US crude inventories.

USDJPY continues to be under pressure due to diverging monetary policies between Japan and the United States.

Investors are now getting ready for the US CPI reading, scheduled to be published later today at 12:30PM UTC.

A higher-than-expected US CPI may hinder the possibility of a larger (e.g. 50bps) interest rate cut next week.

This could also put downward pressure on Brent crude oil prices and cause the volatility in USDJPY currency pair.

More on Oil and Japanese yen below:

Brent

Oil prices rebounded on Wednesday, regaining some of the previous day's losses, as concerns about Hurricane Francine disrupting US production outweighed worries about weak global demand.

Brent crude rose 0.94% to ~$69.89 a barrel, after sliding to its lowest ($68.49 a barrel) levels so far this year.

The market's rebound was driven by supply disruption fears and a decline in US crude inventories.

However, downward pressure may be expected to persist due to concerns about slowing demand in China and the US.

OPEC's downward revision of its demand forecast, and China's lower-than-expected imports also weighed on the market, leading some analysts to predict a bearish outlook.

USDJPY

USDJPY has touched its lowest point (~140.713) this year today,

The Japanese yen has reached its strongest level this year of ~140.713, as the country's monetary policy diverges from that of the US.

BoJ is poised to continue its interest rate hikes if inflation trends align with its projections (according to BoJ board member Junko Nakagawa).

Nakagawa cited the tight labor market and persistent increases in import prices as potential catalysts for upward inflationary pressure.

In contrast, US Fed is anticipated to initiate a rate-cutting cycle this month, with policymakers expressing concerns about the labor market's growing vulnerabilities.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.